According to the Financial System Indicators the performance of state banks such as Banco Hipotecario (BH) and Banco de Fomento Agropecuario (BFA) as of may 2021 registered an inter-annual growth of 30.40% the amount of deposits is US$1,579.5 million; in relation to loans the inter-annual growth is 6.12% with an amount of US$1,189.9 million.

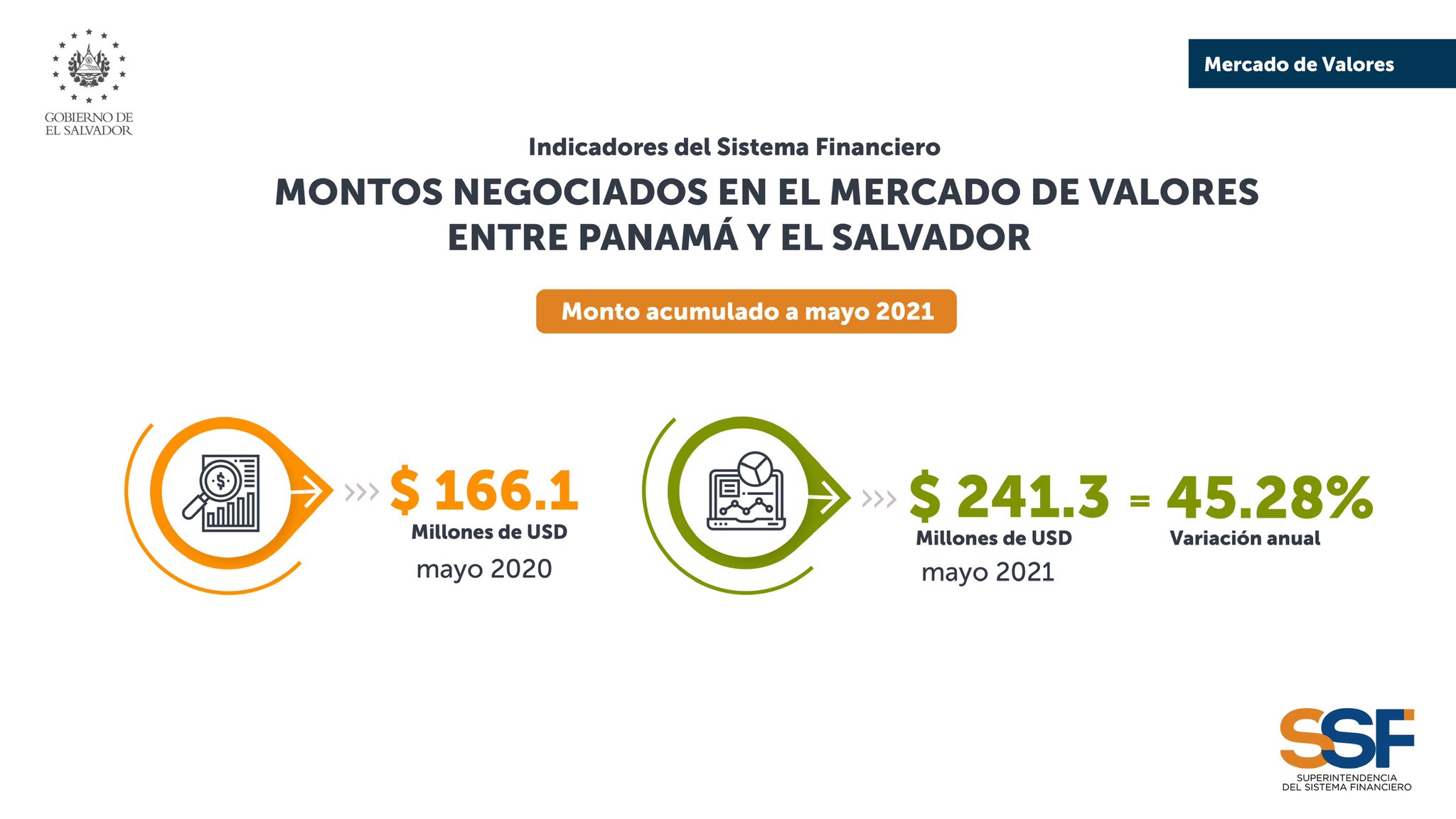

In addition, the Superintendency also presented, the amounts traded in the stock market between El Salvador and Panama as of may 2021, which reached an accumulated total of US$241.3 million, with an annual variation of 45.28% which demonstrates the interest in investing in both countries, unlike 2020 for may only reached an amount of US$166.1 million.

There is also a growth in savings accounts of 10.5% as of june 25, 2021 with respect to the same date in 2020, thus reflecting the soundness of the country's banking sector, the evolution of savings accounts according to the Financial System Indicators is US$5,276.8 million, with respect to last year which was US$4,776.5 million.

English

English  Español

Español