This includes financial assistance to 53 low-income countries and grant-based debt service relief to 29 of its poorest and most vulnerable member countries. We estimate that in 2020, IMF support provided additional spending of 0.5% of GDP in emerging market economies and nearly 1.0% of GDP in developing countries. IMF support focused on what matters most.

As a result of the pandemic, debt and deficits, already at historically high levels, have increased dramatically. On average, in 2021, global fiscal deficits as a share of Gross Domestic Product (GDP) stood at 9.9% for advanced economies, 7.1% for emerging market economies, and 5.2% for low-income developing countries. Public debt is projected to approach 99% of GDP by the end of 2021.

Favorable global financial conditions have allowed countries with low credit risk to deploy a substantial and lasting expansion of public spending to respond to the pandemic. However, in countries with more limited access to external financing, primary spending is projected to be even lower than anticipated before the pandemic.

Multilateral action is urgently needed to reduce disparities in access to vaccines, and end the pandemic.

In this regard, the recent IMF staff proposal for US$50 million to end the pandemic, endorsed by the World Health Organization (WHO), the World Bank (WB) and the World Trade Organization (WTO), targets vaccination of at least 40% of each country's population by the end of 2021 and at least 60% by mid-2022, while seeking to ensure an adequate volume of therapeutic and diagnostic supplies.

Progress has been made on several fronts, but efforts need to be redoubled. The COVID-19 Vaccines Working Group has also launched a data dashboard to clearly identify and urgently address gaps in access to COVID-19 tools.

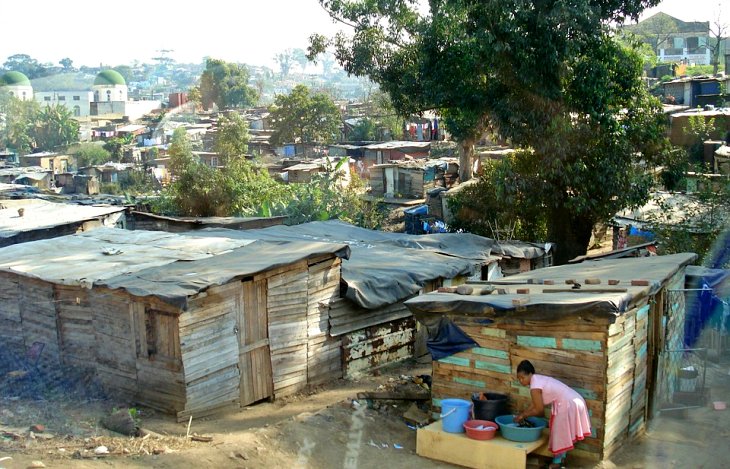

Countries will also need to look at how they mobilize resources domestically and improve the quality of spending. COVID-19 has exacerbated the tension between important development needs and scarce public resources. To raise much-needed tax revenues, governments will need to strengthen tax systems, a particularly challenging task as tax competition, tax base allocation issues and aggressive tax planning techniques have put income taxation under pressure.

However, it is possible to raise revenue, and it should be done in a growth-enhancing and inclusive manner. Governments should seek to improve efficiency, simplify tax codes, reduce tax evasion and improve progressivity. It will also be essential to strengthen the state's capacity to collect taxes and enhance the role of the private sector. For the duration of the pandemic, fiscal policy must remain nimble and responsive to changing circumstances.

English

English  Español

Español