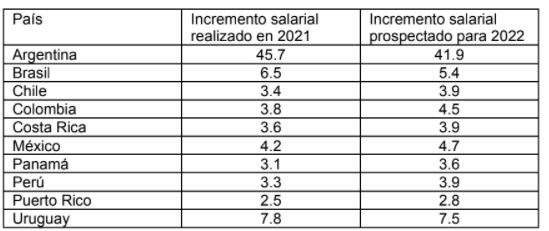

In the latest annual Salary Budget Planning Report by the leading consulting and brokerage solutions firm, salary increases in Latin America mostly show growth compared to salary increases realized in 2021.

Even though most of the Latin American countries participating in the study show a slight growth in the percentage increases, there are some exceptions, such as Argentina, which has reduced its budget by 3.8% compared to the increase in 2021.

Brazil and Uruguay are in the same position as Argentina, reducing the percentage of salary increases by 1.1% and 0.3% respectively compared to the previous year. The rest of the countries included in this study report a growth in the overall budget of projected salary increases for 2022 of between 0.3 and 0.7%, with Costa Rica (0.3%) and Puerto Rico (0.3%) registering the least change, followed by Chile, Mexico and Panama, which report a 0.5% increase in budget, Peru (0.6%) and Colombia (0.7%) with the largest increases in their percentages. The impact of the pandemic on the economy of the Latin American region has limited the growth in the percentage of overall projected increases, prioritizing merit-based increases.

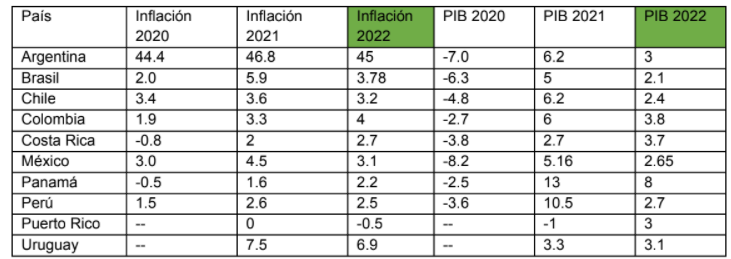

The economic consequences continue to be the main trigger for adjustments in prospective salary increases, and although the percentage of inflation continues to be fairly controlled, and even declining for most countries, the Gross Domestic Product (GDP) continues to be the most important element of the economy.

Gross Domestic Product continues to be the element that has had the greatest impact.

*All figures as percentages

* All figures correspond to information collected in may and june 2021, this release does not consider more recent estimates, all data including economic projections and estimated salary increases reflect market conditions observed in this period.

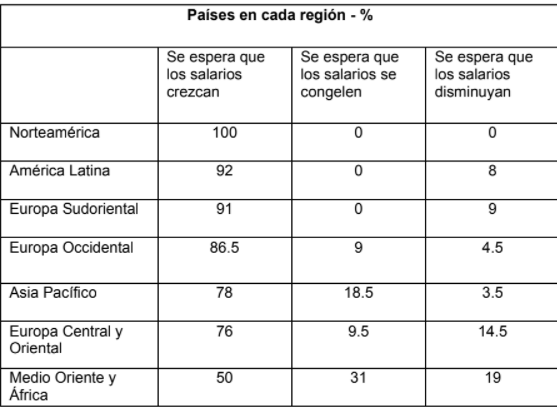

Globally, many sectors are reporting economic recovery and the projected wage increases for 2022 are reflective of the outlook for market recovery to a large extent and commensurate with the different industries as they continue to develop operating strategies in the face of the pandemic. Adjusting to a new way of operating with hybrid work models, a booming labor market and the challenge of keeping employees engaged without the office environment will likely mean more aggressive salary growth strategies to retain top talent.

The war for talent is impacting salary increases, Rich Luss, senior economist at Willis Towers Watson asserts "If demand for labor remains high and supply growth is slow, we would expect organizations to feel pressure to increase compensation to attract the employees they need"

As the talent market continues to transform, business leaders view talent retention as critical to organizational success, so despite the economic challenges imposed by the pandemic, organizations are looking to regain pre-COVID-19 levels of planned increases.

Under the current scenario, frozen raises are trending favorably downward in all countries participating in the study, with reductions of up to 8.5% of companies considering freezing salary increases compared to frozen raises in 2021. Argentina, Panama, Puerto Rico and Uruguay expect not to freeze salary increases, Brazil (0.5%) and Colombia (0.8%) expect less than 1% of participating companies to freeze increases. Peru (1.2%), Chile (1.6%), Mexico (1.7%) and Costa Rica (1.9%) are the countries that plan to freeze wage increases above 1%, versus the 8.5% that was implemented this year.

English

English  Español

Español